$SOL/USDT est en train de retester la neckline d’un Double Bottom face à Bitcoin — un signal technique majeur. Historiquement, ce type de configuration ouvre la voie à de fortes phases de surperformance.

👉 Si le support tient et que le rebond s’enclenche, $SOL pourrait non seulement outperform $BTC, mais aussi viser un retour vers ses anciens sommets proches de $295.

⚠️ En revanche, si la neckline cède, le scénario bullish est invalidé.

💡 Insight clé : Solana n’est plus seulement un “ETH killer” narratif. Avec son écosystème NFT, DeFi et Prediction Markets en pleine expansion, il attire désormais des flux réels et massifs de capitaux. Ce n’est pas seulement un trade technique, c’est aussi un pari sur l’adoption.

👉 Pensez-vous que Solana est prêt à réécrire son histoire face à Bitcoin ? Votez, commentez et suivez ma page pour plus d’analyses exclusives. ⚡

#Solana #CryptoMarkets #cryptocurrency #blockchain

Carmelita

2025-10-03 09:11

🔥 SOL vs BTC : Le Match de la Surperformance Est-il Lancé ?

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

✨ Lors de Ju.com I’MPOSSIBLE NIGHT, notre BD Lead Jacky a livré un keynote inspirant sur #JuChain !

Voici les points clés : 🔹 JuChain → 1ère blockchain L1 conçue comme hub de trafic on-chain 🔹 Communauté dev florissante → plus besoin de courir après le PMF, les builders peuvent scaler dès le jour 1 🔹 48,8M transactions & 551K comptes actifs depuis le mainnet → une traction solide dans le marché actuel 🔹 Secteurs en croissance ciblés : GambleFi, DeFi, SocialFi, projets communautaires & DePIN

JuChain continue d’outiller builders & communautés, avec l’ambition de devenir le moteur ultime de croissance on-chain.

#JuChain #Web3 #BlockchainInnovation #cryptocurrency #blockchain

Carmelita

2025-10-03 07:41

✨ Lors de Ju.com I’MPOSSIBLE NIGHT, notre BD Lead

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

📊 Plus de $250M de positions shorts liquidées en 24h : $101M sur $ETH/USDT $95.5M sur $BTC/USDT

👉 Ce flush massif remet les acheteurs aux commandes. Les liquidations agissent comme du carburant forcé, renforçant l’élan haussier.

⚡ Tant que le marché reste sur levier, chaque purge de shorts peut déclencher une nouvelle jambe haussière. La dynamique est en faveur des bulls.

#Bitcoin #Ethereum#cryptocurrency #blockchain

Carmelita

2025-10-03 07:15

🔥 Les ours brûlent, les taureaux reprennent le volant

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

$HBAR/USDT reteste la ligne de cou du double bottom tout en s’enroulant dans un wedge descendant. Tant que ce support clé tient, la dynamique reste en faveur d’un reversal haussier.

🎯 Objectifs : TP1 : $0.27 TP2 : $0.30 TP3 : $0.34

Un breakout clair du wedge pourrait ouvrir la voie à une nouvelle jambe haussière.

👉 Gardez l’œil sur ce niveau : c’est souvent de là que partent les mouvements explosifs.

#HBAR #altcoins #cryptocurrency #blockchain #technical analysis

Carmelita

2025-10-03 07:24

🔥 $HBAR : Prêt à décoller ?

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Two big developments have recently stirred market sentiment. First, Google’s new AI model Gemini was heavily hyped before launch—its IPO book was reportedly over 20x subscribed—signaling strong investor appetite for a U.S. home-grown “crypto exchange concept.” After listing, it jumped 32% before suffering a sharp pullback, but there’s no denying Gemini shook the market.

The second is NVIDIA (NVDA.O) taking phased equity stakes in OpenAI, with a total planned investment of $100B and an initial $10B tranche.

The message behind both is crystal clear: AI has become the dominant narrative in global capital and tech, while crypto, as another fast-moving innovation track, is actively seeking points of fusion with AI. From capital flows to applications, from hype to real deployments, AI + Crypto is no longer a distant vision—it’s a new track forming at speed.

Put simply, AI and crypto naturally intersect across data, compute, and value transfer: AI needs data and compute; blockchains can offer decentralized compute markets, verifiable data provenance, and tokenized incentive mechanisms. Crypto needs fresh application narratives; AI fits that bill. Hence “AI + Crypto” has become the new hot wind drawing in capital, founders, and speculators alike.

But key questions remain:

Where exactly do AI and blockchains fit together?

Are AI + Crypto projects a long-term trend or short-term hype?

How should everyday users understand this emerging space?

Below is a clear primer on the logic, use cases, opportunities, and risks of AI + Crypto.

Why AI and Blockchain Fit

The Value of Data Data is AI’s fuel; blockchains excel at ownership and transfer. In Web2, data sits with giants. Blockchain enables user data ownership and access control (via wallets and DID), and even token incentives for contributing training data—making personal data as an asset possible.

Marketizing Compute Training models requires massive compute, currently concentrated in NVIDIA GPUs, Google TPUs, etc., at high cost. Blockchains can coordinate decentralized compute networks, pooling idle resources into an “Airbnb for compute.” Anyone can rent out compute for tokens; AI gets cheaper, more flexible capacity.

Incentives & Collaboration AI model development is resource-intensive. Token economics offer a global incentive layer: issue tokens to coordinate developers, data providers, and compute contributors—addressing the Web2 problem where a centralized company captures most value.

Trust & Transparency AI’s “black-box” problem looms large. Blockchains’ transparency and immutability add verifiability to training and inference. In the future, you could audit which data a model used and how it was trained, with guarantees against tampering.

AI + Crypto Use Cases

1) DeFi: AI-Driven Smart Finance

DeFi replaces intermediaries with code; AI makes it smarter.

Smart advisory: Instead of guessing or following KOLs, AI can scan tens of thousands of pools and markets in real time and tailor strategies to your risk and account size.

Risk management: AI flags anomalies—e.g., whale hopping, sudden flow spikes—giving early warnings on protocol stress.

Automated trading: Open data + model access let individuals run AI-assisted quant strategies. Set risk rules; let AI generate and execute while you sleep.

Tomorrow’s wallet won’t be static—it will act like a personal AI finance copilot.

2) NFT & Creation: From Static Collectibles to Dynamic Interaction

Wave 1 NFTs were avatars; AI ushers in dynamic creation.

AI art + NFTs: Mint characters that evolve with each issuance—boosting collectability and interaction.

Music & writing: AI generates tracks, lyrics, texts; creators tokenize works and automate royalties in smart contracts, avoiding platform over-taxation.

Gaming: AI crafts unique NPCs, maps, or storylines per player; these assets can be tokenized and traded—forming new in-game economies.

So AI + NFT turns a JPG into a living, tradable, interactive digital organism.

3) AI Agents on-chain: Your “Digital Twin”

Hot topic: AI Agent + Wallet. Give AI a wallet and rules; it executes for you.

No time to watch markets? Agent rebalances.

DAO voter fatigue? Agent votes per your preferences.

Airdrop chores? Agent farms routine on-chain interactions—even across multiple wallets.

If wallets are Web3’s entry, Agent + Wallet may be the next super-app doorway.

4) Decentralized Compute Networks: Fuel for AI

Compute is AI’s chokepoint. Projects like Render, Bittensor, Akash build decentralized compute networks.

Households can plug in GPUs for token rewards.

AI teams rent capacity cheaply without buying hardware.

Token incentives drive network growth.

If AI is the new oil, decentralized compute is both refinery and marketplace.

5) Security & Compliance: AI as Web3’s Gatekeeper

Web3 is opportunity-rich but risk-heavy. AI can guard the gates.

Security: Detect phishing, fake addresses, even smart-contract backdoors. Imagine an AI pop-up: “Warning: this contract can drain funds.”

Compliance: Support AML via flow analysis; automate KYC checks; cut costs.

Regulatory fit: Help projects adapt to jurisdictional rules and avoid red lines.

AI won’t just create wealth—it will protect it.

Bottom line: AI is already penetrating every corner of blockchain—from DeFi and NFTs, to Agents, compute, and security.

AI + Crypto: Key Terms

AI: Systems that learn, reason, and decide like humans.

Smart Contract: Auto-executing code on-chain.

Machine Learning (ML): Core AI discipline enabling models to learn from data.

Deep Learning: Neural-network-based learning powering modern big models.

LLM: Large language models (e.g., GPT, Gemini) that understand/generate text.

Data Labeling: Curating structured datasets for training.

Compute Network: Decentralized GPU/TPU markets for AI workloads.

Decentralized Storage: e.g., Filecoin, for datasets/model weights.

On-chain Identity / DID: Verifiable identities to personalize AI.

AI Agent: Autonomous agent executing tasks (including on-chain).

Generative AI: Creating text, images, music, code, etc.

Privacy-Preserving Computation: Cryptographic methods to protect training data.

Cross-chain Protocol: Bridges interoperability for data across chains.

Sentiment Analysis: AI infers investor mood for trading signals.

Narrative: The investment storyline—here, AI × blockchain as a growth vector.

Conclusion: The Long-Term Value of AI + Crypto

There will be hype in the short run, but over time AI and crypto genuinely complete each other. AI needs decentralized compute and data; crypto needs new use cases and narratives. Their convergence is a natural experiment.

As a user, ignore day-to-day noise and see the arc: the internet is becoming more intelligent and more decentralized. AI + Crypto may be the crucial puzzle piece on that road.

#cryptocurrency #blockchain #JuExchange #AI #Crypto

Lee JuCom

2025-10-03 04:36

⚜️ Ju.Com Education Series: A Primer on AI + Crypto | Part 7

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

La plus grande banque américaine, avec $4.3T d’actifs sous gestion, affirme que $BTC/USDT est massivement sous-évalué. Selon leurs analystes, le prix actuel ne reflète pas son rôle croissant dans le “debasement trade”, et le potentiel pourrait aller bien au-delà si cette dynamique s’accélère.

👉 Le contraste est saisissant : après des années de FUD et de scepticisme, Wall Street pivote. Même Jamie Dimon, l’éternel critique de Bitcoin, voit ses arguments vaciller. 🟠

⚡ Quand les plus grandes banques mondiales annoncent que Bitcoin est sous-évalué, ce n’est plus seulement une opinion crypto-native — c’est un changement de narratif institutionnel.

La question n’est plus si Bitcoin sera adopté, mais jusqu’où il peut aller.

#Bitcoin #crypto #cryptocurrency #blockchain

Carmelita

2025-10-02 23:04

💥 JPMorgan valorise Bitcoin à $165,000

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Après avoir annoncé $400M pour constituer une méga-trésorerie en Solana, la société valide maintenant jusqu’à $100M de rachat d’actions — réduisant son flottant et affichant une confiance totale dans son virage crypto.

👉 Pour #Solana, c’est bien plus qu’un signal :

-

Demande institutionnelle en pleine expansion

Staking activity en hausse, renforçant la sécurité du réseau

Crédibilité corporate qui s’ancre dans l’écosystème

Un pas de plus vers l’adoption massive : Solana n’est plus juste une blockchain performante, c’est une réserve stratégique pour les entreprises.

⚡ Question : qui sera le prochain corporate à suivre cette stratégie ?

#Solana #Crypto #cryptocurrency #blockchain $SOL/USDT

Carmelita

2025-10-02 19:36

🔥 Sharps Technology passe en mode “Hold my $SOL”

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Le réseau Aptos ($APT/USDT ) déroule le tapis rouge pour le stablecoin USD1, porté par World Liberty Financial, le projet DeFi lié à la famille Trump. 🇺🇸💵

📅 Lancement : 6 octobre 2025 ⚡ Disponible instantanément sur les principaux protocoles DeFi, wallets et exchanges.

👉 Si l’adoption suit, Aptos pourrait rapidement se positionner comme un nouveau hub DeFi majeur, attirant capitaux et liquidité.

Intéressant : ce lancement mêle politique, innovation et finance décentralisée.

#DeFi #Aptos #cryptocurrency #blockchain #Finance

Carmelita

2025-10-02 16:02

Aptos ouvre la voie à USD1 !

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

La société brésilienne OranjeBTC fera son entrée en bourse sur B3 la semaine prochaine, devenant la première entreprise cotée du pays à adopter une stratégie de trésorerie Bitcoin ($BTC/USDT ). 💎

🔥 Un signal fort : l’Amérique Latine ne se contente plus d’observer, elle prend désormais les devants sur la scène crypto mondiale.

La question n’est plus si mais quand le Brésil deviendra un moteur majeur de l’adoption crypto.

#Bitcoin #LatinAmerica #cryptocurrency #blockchain

Carmelita

2025-10-02 15:12

🇧🇷 Le Brésil entre dans la cour des grands avec OranjeBTC

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Une chance unique de construire & diriger avec #JuChain.

🎯 Appel à tous les builders : 👩💻 Fondateurs 🛠️ Développeurs 🎨 Créateurs 🌍 Leaders communautaires

Accédez à des ressources exclusives : • 💸 Financement d’incubation • 🤝 Introductions directes aux VCs • 🌐 Événements privés de l’écosystème

⚡ Places limitées. Tu es prêt à passer au niveau supérieur ?

👉 Postule ici : https://forms.gle/uXFZzppv7AzYLRg39 En savoir plus : https://juchain.org/en/blog/49

#JuChain #JuForce #Web3Builders #cryptocurrency #blockchain

Carmelita

2025-10-02 15:16

🚀 JuForce recrute dès maintenant !

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Tyler & Cameron Winklevoss — connus comme les jumeaux milliardaires du Web3 et ex-rivaux de Facebook — viennent de frapper fort. 👉 Ils ont fait don de 188+ $BTC$BTC/USDT au Digital Freedom Fund PAC.

🎯 Leur objectif : soutenir Trump et transformer les États-Unis en “capitale mondiale des cryptos”.

Un geste qui illustre comment la politique et les grandes fortunes crypto s’entrelacent pour redessiner les rapports de force à l’échelle mondiale. 🌍⚡

#Bitcoin #CryptoPolitics #cryptocurrency #blockchain

Carmelita

2025-10-02 14:22

💥 Les frères Winklevoss s’allient à Trump pour le futur des cryptos

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

$LINK/USDT rebondit parfaitement sur la zone des $20 ✅, exactement comme anticipé. Le prix reste encore assez bas pour offrir une nouvelle entrée intéressante.

🎯 Objectifs : Premier target : $30 Second target : $50

⚠️ Stops prudents à placer sous les $20 pour limiter le risque.

👉 Un signal clair que Chainlink reste l’un des projets les plus solides à surveiller en cette phase de marché.

#Chainlink #CryptoTrading #cryptocurrency #blockchain

Carmelita

2025-10-01 22:15

✨ $LINK : opportunité en cours

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

$AVAX/USDT commence déjà à porter ses fruits ✅, et il reste encore de la place pour prendre position.

📌 Zone d’entrée idéale : $30–31 📌 Stop de sécurité : $25 📌 Target principal : $50

📊 Le ratio risque/rendement reste attractif, avec un scénario haussier toujours largement ouvert.

#Avalanche #CryptoTrading #technical analysis #cryptocurrency #blockchain

Carmelita

2025-10-01 22:42

✨ $AVAX : opportunité d’entrée validée

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Alors que le gouvernement américain s’est arrêté net à minuit — politiques figés, employés mis en pause — #Bitcoin , lui, a décollé.

👉 Les capitaux se réallouent déjà vers le $BTC et l’or, les seuls actifs qui n’attendent ni signatures, ni autorisations pour tourner. ⚡ Quand Washington s’éteint, Bitcoin s’allume. Le honey badger s’en fiche, il avance.

#CryptoMarkets $BTC/USDT #cryptocurrency #technical analysis #blockchain

Carmelita

2025-10-01 21:52

🔥 Bitcoin, l’actif anti-shutdown

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

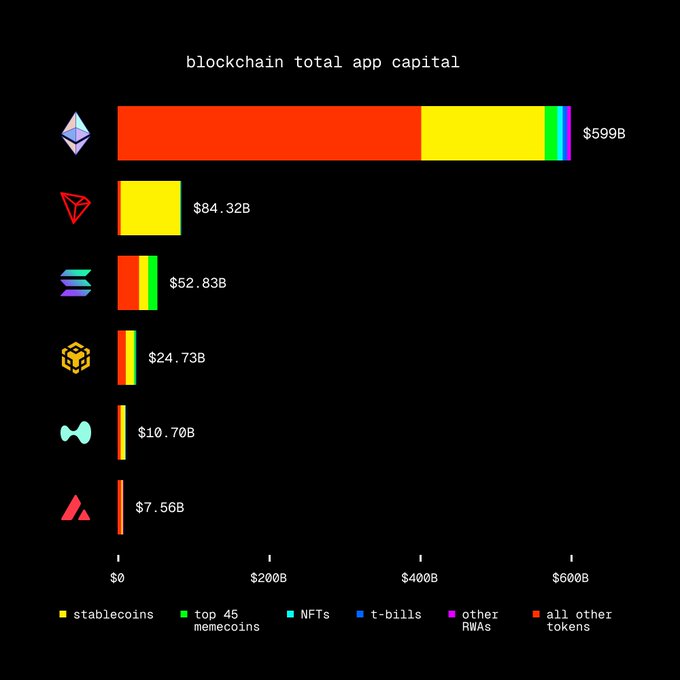

Avec 599 Mds$ de capital total verrouillé dans ses apps, $ETH/USDT écrase littéralement toutes les autres blockchains réunies.

Quand la liquidité choisit un écosystème, c’est lui qui fixe les règles. Plus de capital = plus de confiance = plus d’adoption. Ethereum n’est pas seulement leader… il est devenu le marché lui-même.

👉 Restez attentifs : chaque nouveau flux institutionnel et chaque RWA tokenisé renforce encore cette dominance.

#Ethereum #CryptoAdoption #cryptocurrency #blockchain

Carmelita

2025-10-01 14:08

📌 Ethereum, le cœur battant de la liquidité on-chain 🌊

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

En seulement 7 jours, les entrées nettes sur $SEI/USDT ont doublé 🔥. Un signal clair : la rotation de capitaux s’accélère, la confiance grandit et la dynamique se renforce rapidement.

⚡ Quand les flux frais s’intensifient, c’est souvent le signe avant-coureur d’un mouvement de prix majeur. Les investisseurs ne suivent pas le bruit, ils suivent la liquidité.

$SEI/USDT comme un simple trade de momentum ou comme une vraie position long terme ?

#altcoins #CryptoMarkets #cryptocurrency #blockchain

Carmelita

2025-10-01 14:31

📌 $SEI attire un afflux massif de capitaux

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

👥 Foule au rendez-vous

🎮 Jeux & giveaways en action

🟠 Et notre emblématique orange qui illumine Marina Bay Sands

Nous ne sommes pas seulement présents…

👉 Nous faisons vibrer TOKEN2049 avec l’esprit **Rewrite the Impossible**.

📍 1–2 Octobre | Marina Bay Sands

#JuChain #JuCom #TOKEN2049 #cryptocurrency #blockchain

Carmelita

2025-10-01 14:18

🔥 Le stand JuChain enflamme #TOKEN2049 Singapore!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

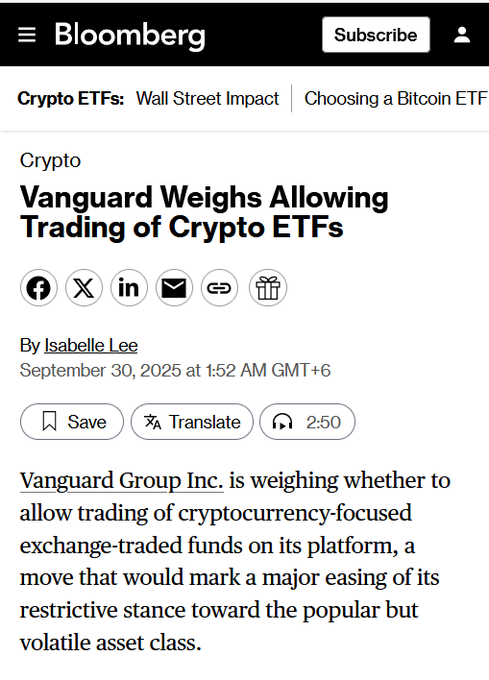

🚨 Le 2ᵉ plus grand gestionnaire d’actifs au monde, longtemps considéré comme anti-crypto, envisage désormais d’intégrer des produits liés aux actifs numériques sur sa plateforme de courtage. 👀

🌊Quand des géants comme Vanguard amorcent un virage, cela marque un changement structurel profond. Après BlackRock & Fidelity, voir Vanguard s’intéresser à la crypto, c’est la validation ultime : la finance traditionnelle n’ignore plus le secteur, elle l’intègre.

👉 La question n’est plus “si”, mais “comment et quand”.

#Bitcoin #CryptoAdoption #cryptocurrency #blockchain

Carmelita

2025-10-01 13:47

📌 Vanguard (9,3T$) prêt à ouvrir la porte à la crypto ?

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

🔸BTC: $116,337

🔸ETH: $4,297

🔹Fear/Greed: 49 (Neutral)

🔹BTC.D: 58.83%

🚀 Bitcoin is pushing toward $117K, riding momentum from a strong September (+5.2%) and Q3 (+6.3%). The next big resistance sits near $117.5K — a breakout there could open the path to new ATHs.

💡 Still, liquidity dynamics remain tricky. Heavy long positions are stacked just below price, and some analysts warn that BTC could dip to “flush” leverage before continuing higher.

🥇 Meanwhile, gold hit another all-time high at $3,895/oz, reviving the BTC–gold correlation. Historically, Bitcoin has lagged gold by weeks before catching up, and some traders now see conditions aligning for a rotation from gold into BTC.

In short: Bitcoin looks strong, but with liquidity traps lurking below, the next few sessions will show whether bulls can flip $117.5K into support — or if another shakeout comes first.

#JuExchange #Bitcoin #cryptocurrency #blockchain #finance

Lee JuCom

2025-10-01 12:03

📈 Market Overview (01/10/2025)

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What it means?

A government shutdown occurs when the US Congress fails to pass a budget to fund federal agencies. Without a spending bill, government departments are shut down, workers are furloughed, and the release of important economic data (like inflation or NFP) is delayed.

Why now?

October 1 marks the new fiscal year, and if lawmakers can't agree, a government shutdown will begin. That's exactly what happened — the shutdown has begun. Democrats are pushing for social programs and benefits, while Republicans — led by Trump — want a "clean" funding bill without those costs. For Trump, it’s also a political weapon: to pressure Democrats, create gridlock, and show toughness.

Market Impact:

🟡 Economic Data: Delayed data means the Fed is acting rashly, making rate decisions less predictable.

🟡 Volatility Premium: Investors demand more safety → volatility spikes.

🟡 Economy: Each week of government shutdown costs about 0.1–0.2% of GDP.

🟡 Assets: Gold typically rallies, stocks tumble, and the dollar reacts nervously.

Cryptocurrency:

🟡 Short-term: the government shutdown could put pressure on risk assets, including Bitcoin, as investors reduce risk.

🟡 Long term: Ironically, government dysfunction often strengthens the argument for decentralized assets. Plus, if the Fed sees a weaker economy, more rate cuts are likely — which means more liquidity flowing into the market.

#JuExchange #cryptocurrency #blockchain #technical analysis #Finance

Lee JuCom

2025-10-01 12:01

🟠 Let's break down what a government shutdown actually is and why it matters now.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.